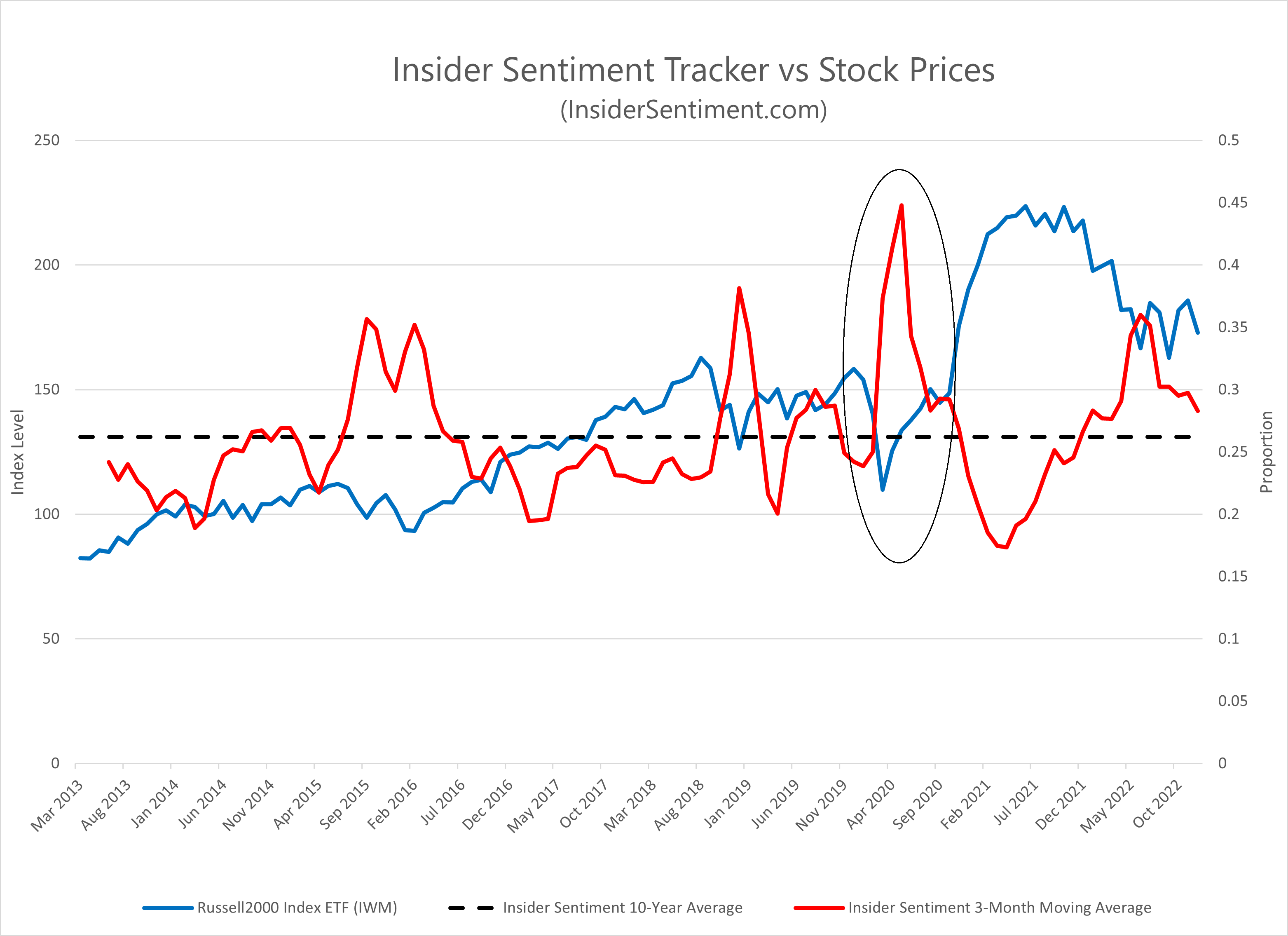

Research for the last 60 years shows that insiders are consistently the most informed of all traders in the equities market

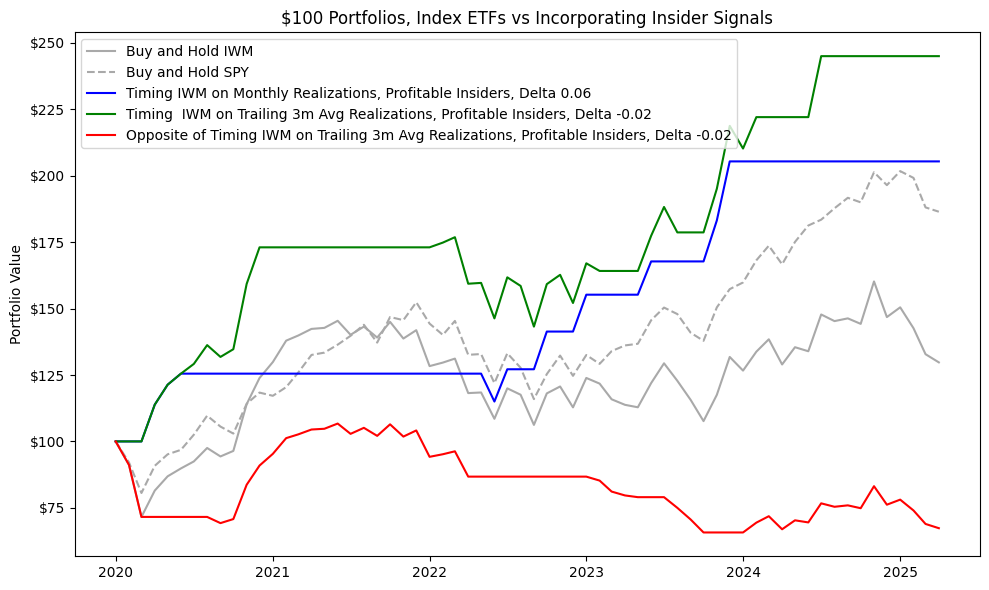

Insiders buy their own firm's stock before the price goes up and sell before it goes down, beating the market by about 5% each time. They achieve a return that is triple the market return (on average, on a one-month horizon). 1

In contrast, nearly 90% of actively managed equity funds fail to beat the market over 10 years. 2

That's why if you are an active trader, money manager, or personal investor who makes significant investment decisions on a 2-to-12 month time horizon, you need to know what signals insiders are sending.

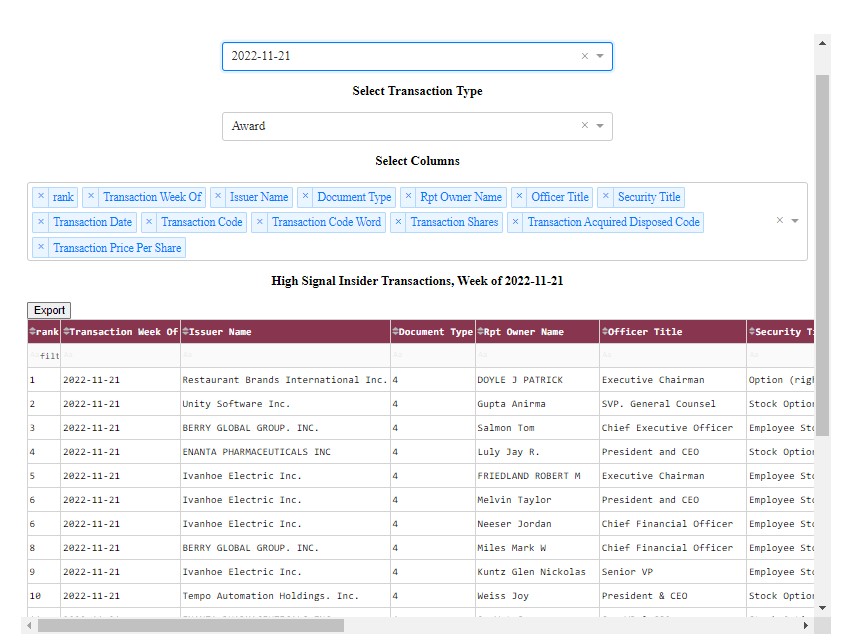

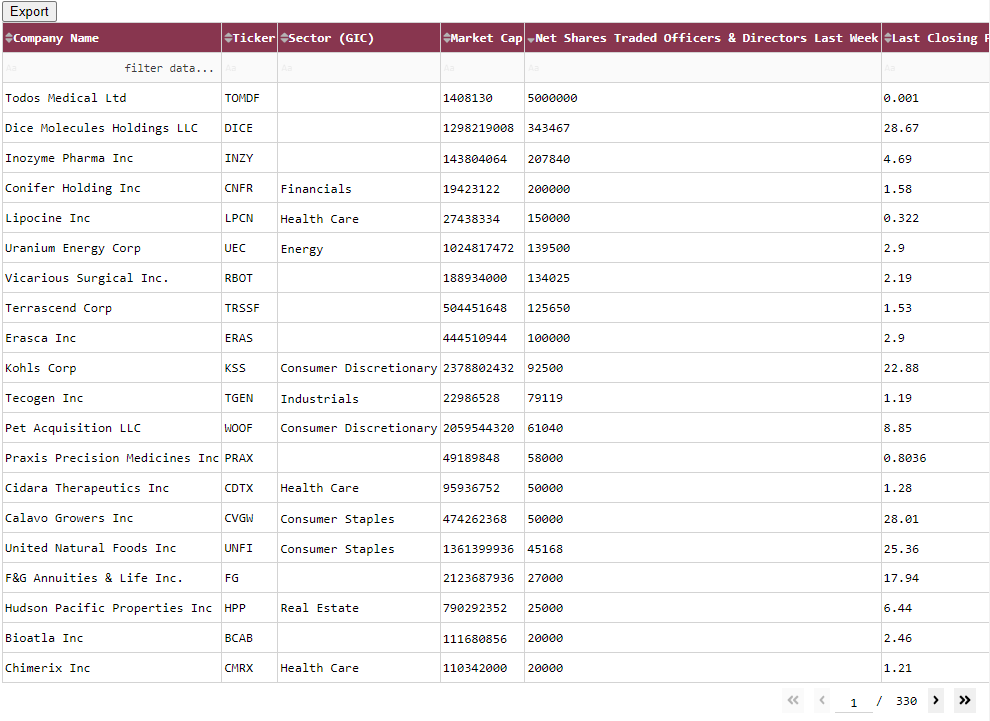

In collaboration with Professor H. Nejat Seyhun of the University of Michigan Ross School of Business , the Insider Sentiment Dashboard utilizes more than 40 years of academic research to bring you insights from the world of insider transactions.

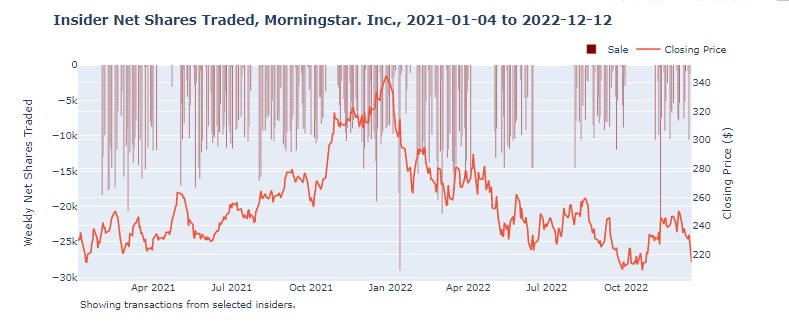

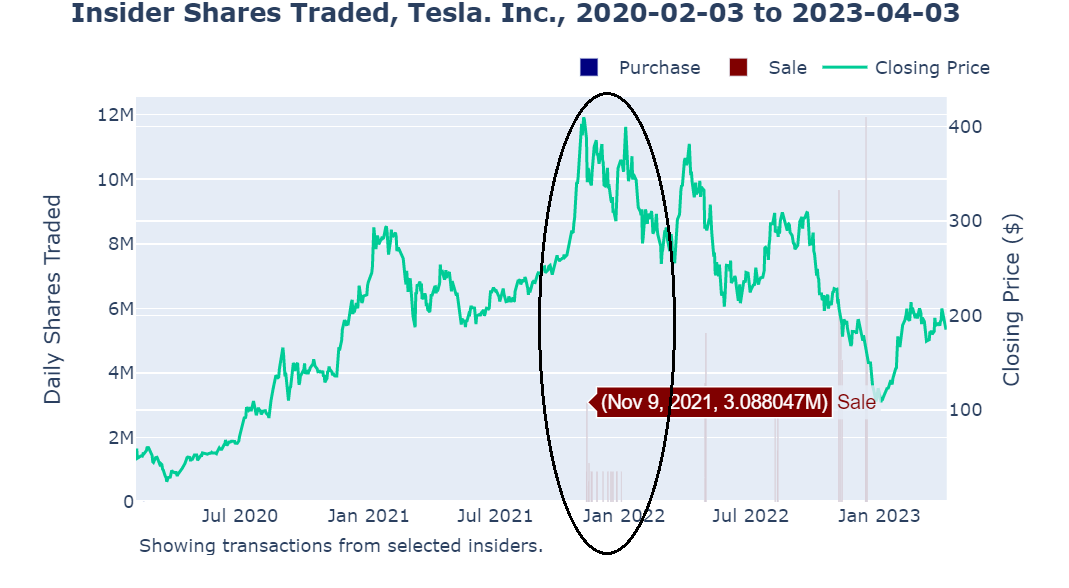

Above: Elon Musk announced a $20 billion sale of Tesla shares as the stock went above $400. That was a historic peak in the stock price.

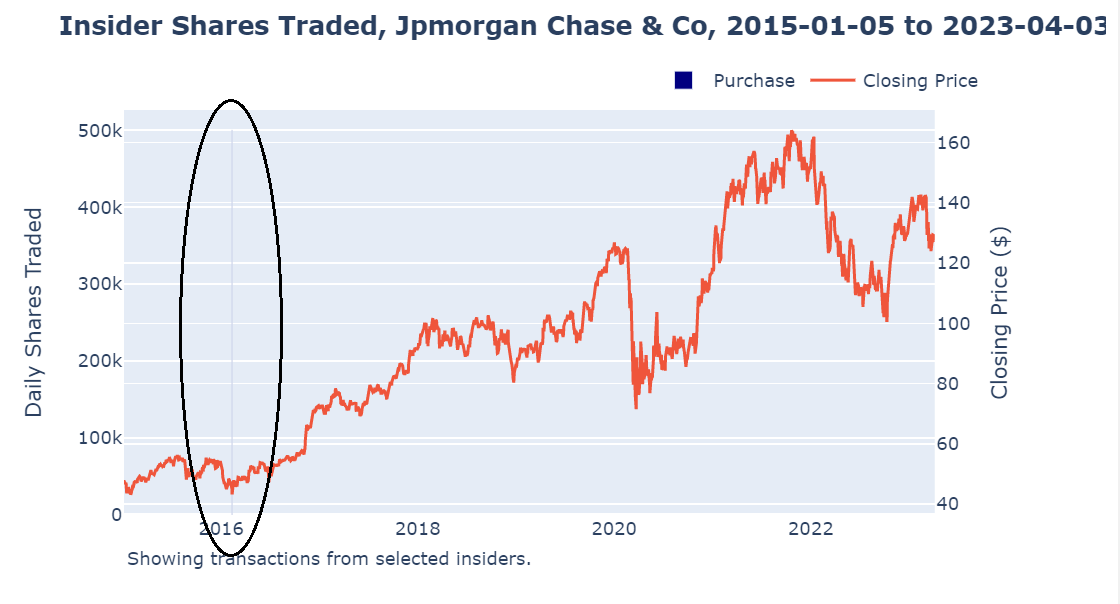

Below: Jamie Dimon purchased $25 million of JPM after the price dipped below $50. It has not traded that low since.