Insider Sentiment Dashboard Walkthrough

February 14, 2024 | InsiderSentiment.com Team

Introduction

Research for the last 60 years shows that insiders are consistently the most informed of all traders in the equities market. Based on the research that we’ve shared in our newsletters and blog posts, we believe investors across the entire spectrum can benefit in some capacity from following the actions of corporate insiders. To that effect, we have built the dashboard at InsiderSentiment.com to provide exactly this information in several different ways. In this article, we will discuss each screen of our dashboard and share how it might be useful to a particular type of investor based on the insider trading information it shows.

First, we will give an overview explaining how various investing styles would benefit from the insider trading information presented in the dashboard, and then we will go through the dashboard itself. In our free newsletter, we will walk through an example of how an investor might use multiple screens of the dashboard in order to identify and research a potential investing opportunity. If you are interested in that example, sign up for our free newsletter, the links to which are on our home page.

Motivation

We believe every type of investor interested in using insider trading data will find something to benefit them in the dashboard on InsiderSentiment.com. Market-timers will value the flagship Insider Sentiment Tracker available on the “Aggregated Insider Transactions by Sector and Size” tab to move between cash and equities. Others may find the sector information useful to overweight or underweight different sectors of the economy.

Firm-size based trading strategies will benefit from understanding aggregate insider transactions separately in large-cap, mid-cap and small-cap firms. They can also combine market-cap with sector information to dig even deeper. (We discuss potential market-timing strategies based on the historical data in other articles on our blog.)

Investors with more quant-based strategies using either Momentum or Value-Growth Styles will find benefit from staying attuned to insiders’ sentiment toward these styles. They can do so by using the “Aggregated Insider Transactions by Momentum and Size” and “Aggregated Insider Transactions by Style and Size” tabs.

Stock picking investors that want to examine individual stocks based on insider transactions can use the ‘Company Screening Tab’ and ‘Firm-Specific Insider Transactions Tab’ to do so.

Investors who make their decisions based on top management turnover, executive compensation, option awards or option exercises will be interested in our ‘All Insider Transactions Tab’. Our data in this tab is highly disaggregated, allowing you to impose your own definition of what kind of insider transactions you consider important. While almost all other providers of insider transactions provide only aggregated data, we also give everything in the raw, trade-by-trade form. For instance, if you consider insider transactions by institutions who typically trade very large volumes as less important, you can exclude this data from further consideration. If you think the most important insider transactions come from CEOs trading over 10,000 shares, again, you can search for companies exhibiting only such trading activity. The flexibility this disaggregated data provides makes it very powerful to the technical researcher.

Now we will go through the dashboard screen by screen, starting with our flagship indicator.

Aggregated Insider Transactions by Sector and Size

On the “Aggregated Insider Transactions by Sector and Size” tab, you’ll find what was formerly our flagship Insider Sentiment Tracker (which has since moved to "Aggregated Profitable Insider Transactions by Size"). The Tracker is based on the share of companies that are net buyers in a given month and is reported going back ten years. We present both the current value of the Tracker as the purple line, as well as the 3-month moving average in red. We like to interpret the Tracker against the 10-year average, which is shown as the horizontal line in black.

You can view insider sentiment for any sector-firm size combination using this tab. For example, instead of viewing insider sentiment for all firms, you might be more interested in insider sentiment in large-cap Energy companies, or perhaps small-cap Financials. This is helpful as sometimes overall sentiment is driven by one or two sectors, or even the opposite scenario where one sector is experiencing sentiment that is totally opposite from the general trend.

Aggregated Insider Transactions by Momentum and Size

The “Aggregated Insider Transactions by Momentum and Size” tab is similar to the “Aggregated Insider Transactions by Sector and Size” tab above, except as the name implies it is made specifically for investors engaging in a momentum strategy. Investors with more quant-based strategies using either momentum or value/growth styles will find benefit from staying attune to insiders’ sentiment toward these styles. They can do so by using the “Aggregated Insider Transactions by Momentum and Size” and “Aggregated Insider Transactions by Style and Size” (below) tabs.

Instead of looking at insider sentiment based on sector, the “Aggregated Insider Transactions by Momentum and Size” tabs allow you to look at insider sentiment for companies that have either a positive or negative return over a given time horizon. For example, if you wanted to see insider sentiment for companies that have had positive stock returns over the last year, you could do so using this tab. That result is provided in the screenshot above, and as you can see, at the time this image was captured (November 2023), insider sentiment for those companies was well below the ten-year average.

Aggregated Insider Transactions by Style and Size

The “Aggregated Insider Transactions by Style and Size” tab is like its two predecessors but instead of viewing insider sentiment for various sectors or momentum factors, it allows you to cut the economy by growth or value and view insider sentiment accordingly. Value has started beating growth for the last couple years, bucking more than the previous decade of trend, only to reverse again in 2022. On this tab, you can split insiders into value, growth, blend, or negative, and use either Earnings or Book equity values to make your selection to understand whether insiders are favoring value or growth at this time.

Aggregated Profitable Insider Transactions by Size

This tab is like the previous aggregated tabs, although it only uses transactions from insiders who trade profitably. As of May 2025, we have moved our flagship series to the "All Sizes" series of this tab, which reflects the results of our recently published research, "Does Insider Trading Predict Stock Market Returns? 2025 Update". Users can filter this tab by firm size. When we refer to the "Insider Sentiment Tracker" in our research, we are referring to the "All sizes" series of this tab.

All Insider Transactions

The “All Insider Transactions” tab is as the name implies, simply all of the insider transactions organized by week. Browse for a particular company, insider, transaction type, or any combination thereof. All of the attributes that appear in the original SEC Form 4 filing are available to you. Premium subscribers also have unlimited exports of this data.

"All Insider Transactions" is the universal database, allowing you to extract whatever information you may desire. Suppose, you want to focus on option awards. In this case, you set transaction code to ‘A' for award, and ‘Underlying Security’ to options. You may focus on option exercises. In this case, you can set the ‘Transaction code’ to ‘M for exercise, and set the underlying security to options again.

Company Screening

We next have to the “Company Screening” tab, where we can screen publicly listed US companies based on fundamental and technical indicators, including insider trading statistics. If you want to find companies that have experienced the most net insider buying in the last 6 months, say, you can do that on this tab. Do note, though, that only the "Net Shares Traded" columns can be downloaded by Pro users.

Firm-Specific Insider Transactions

Next, we move onto the “Firm-Specific Insider Transactions” tab, which allows you to view insider buying and selling plotted against the stock price, providing unique insights related to the profitability of trades performed by that company’s insiders.

These graphs of insider transaction information plotted alongside stock price data for a given publicly traded US company allows the reader to judge for themselves whether, over the past ten years, insider transactions by a certain executive was indeed due to opportunistic trading reasons to take advantage of potential misvaluations, or simply was routine trading. If insiders buy at bottom prices and sell at top prices, that is more likely to be due to opportunistic trading. The opposite pattern may be due to routine trading. Consequently, armed with such historical correlations, you may decide to ignore certain insider trading information or decide to focus your resources on a particular company.

High-Signal Transactions

Last but not least, we have the “High-Signal Transactions” tab. This tab is similar to the “All Insider Transactions” tab, except the transactions here are organized by week and transaction type and automatically sorted descending by size. You can choose to look at either Purchases, Sales, Awards, or Options Exercises and view the largest transactions of the week, updated after every trading day.

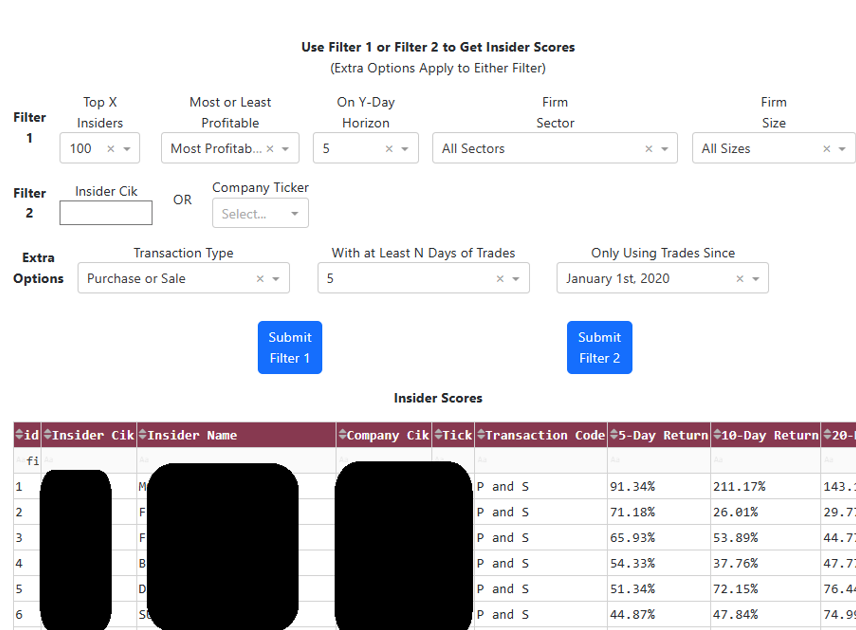

Insider Scores (Pro plan only)

Our newest offering for subscribers to the Professional plan only, Insider Scores allows you to see which insiders have traded most profitably historically. You can select a single insider, all insiders in a company, or the top insiders in a particular industry. Additionally, users can choose to view profitability on different time horizons as well as on various transaction types.

In Summary

The dashboard at InsiderSentiment.com was built with the investor in mind and can provide valuable insights for a variety of investing styles, as we have presented here.

Sign up for our free newsletter to see an example of how an investor might use multiple screens of the dashboard to first find, and then investigate, a potential investment opportunity.